Wise Up

Form 15G, Form 15H, and Form 16 - An Overview

So many times when we are trying to invest money, file our income tax returns, or do almost anything related to finances – we find ourselves thinking – “I wish they taught me this in school!”

But, it’s too late because you’re out of school, and have in fact just landed your first job! Congratulations! Now you have to start taking care of your own money and you might find yourself a bit overwhelmed! This is understandable. When you’re just entering the professional sphere, you already have too many things to learn. And the added headache of having to figure out tax returns and the various documentation processes out there – it’s just nothing anyone has ever actively wanted!

So, today we are going to tell you about three important forms (or documents) that you need to know about if you are –

- An earner.

- An investor.

- A tax-payer.

- All of the above.

Let’s not waste any time – class is in session today – and we’re talking about forms!

Before we get into the various forms we want to touch upon today, it is first important to understand Tax Deducted at Source – more commonly known as TDS.

TDS is a tax instrument that dictates your income to be taxed at the source (from which your income is coming). TDS can be applicable to the interest your savings account earns, rental incomes, dividend payouts, or any commissions you make – any and every source of your income (based on interest) is liable for a TDS deduction. (It is also applicable to your salary – which we will be addressing when we talk about Form 16, a little later!)

What is Form 15G and 15H?

Form 15G and 15H are the tools that can offer you some relief from TDS, provided you meet certain eligibility criteria for it. This means, submitting Form 15G and 15H can make sure that your income through interests or dividends is not taxed (provided it is under ₹2.5 lakh.) So, if you do not file Form 15G or 15H when your earning is within the set limit, then you are paying TDS even though it can be avoided entirely.

Both Form 15G and 15H are self-declaration forms that you can use to request TDS deductions from any source that is giving you an income (depending on your income eligibility). It is also important to remember that the key difference between Form 15G and 15H is that the former is used by those under the age of 60, whereas the latter is meant for senior citizens above the age of 60 when filing tax returns.

Here is the eligibility criteria (and some other important details you need to know) for Form 15G and 15H –

Let us look at an example to understand the purpose of Form 15G and 15H a bit better –

Nisha is 22 years old and just landed her first job, with an annual income of ₹1.5 lakhs. But, thanks to her parents’ help, she has also made some investments, and as a result, she earns ₹40,000 as interest from various deposits, making her total income ₹1.9 lakhs. She can use Form 15G to avoid TDS on the interest as her total income prior to deductions falls under the exemption limit according to the tax slabs.

The thing to remember is this – if you are meeting all the eligibility criteria for TDS deductions, and are not using Form 15G, then you are paying more than you need to in taxes! Yikes!

Eligibility For Form 15G

You may request Form 15G for non-deduction of tax from the interest accrued if and only if you meet the following conditions –

- You are less than 60 years old and are an Indian citizen.

- Your income for the fiscal year is less than ₹2.5 lakh.

- You have zero tax liability for the fiscal year.

*Hindu Undivided Families (HUFs) with an annual income of less than ₹2.5 lakh are also eligible for Form 15G submission.

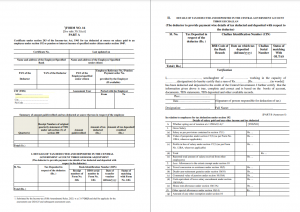

Form 15G is broken down into two parts. Part-I is focused on your personal details like your KYC details, PAN, address, annual income, etc. Part-II of Form 15G contains the details of the source from which you are requesting a TDS deduction, the amount of tax paid, etc., – and this part is typically not filled out by the declarant (you).

Here is what Form 15G looks like –

For Form 15H

You may request Form 15H for non-deduction of tax from the interest accrued if and only if you meet the following conditions –

- The declarant is a senior citizen, i.e. an individual aged 60 or above.

- The Form 15H declarant must be an Indian resident.

- The declarant’s annual taxable income for the fiscal year is nil.

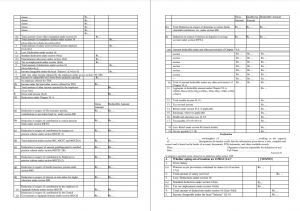

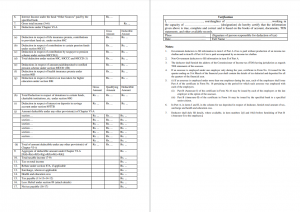

Form 15H is broken down into two parts as well. Part-I is focused on the declarant’s personal details, PAN, approximate income for the annual year, etc. Part-II of Form 15H contains information about the person or institution that is deducting the declarant’s income at source (for example – banks).

Now, if you are here reading about taxation for the first time, we’re guessing that you probably don’t have to think about Form 15H for a few decades still, but it never hurts to know what you’re in for in the future! So, here is what Form 15H looks like –

When to submit Form 15G and 15H?

You should ideally submit a Form 15G with your income source, as soon as the new financial year begins.

Form 16

So far we’ve talked about Form 15G and 15H, both of which are used to save tax from auxiliary incomes (interest incomes). But, what about your regular income? Is TDS applicable to that too? Yes. If you look at your salary receipts or breakdowns, you will find out just how much TDS your employer is deducting from your salary each month. Keep in mind that the TDS can be anywhere from 10% to 30% depending on your income and tax slab.

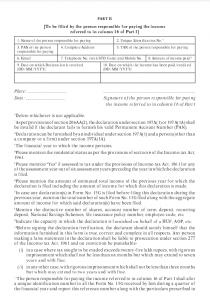

According to the Income Tax Act of 1961, an employer is mandated to issue a Form 16 (typically with a quarterly breakdown) to any employee who draws an annual income of more than ₹2.5 lakhs, which they will need while filing their Income Tax Returns (ITR) annually. Employers are expected to do this by the end of May every year (but it may vary from company to company).

Here is what Form 16 will look like –

So, there you have 3 important forms that you need to know about today, and from a future perspective. Proper documentation and divulsion of your investments and tax-saving schemes can help you get tax refunds, and as such, these are all important tools to help you with your financial planning.

Keep watching this space to learn more about important documents that you will need in your financial journey!

FAQs

- What is the use of forms 15G and 15H?

Forms 15G and 15H are the tools that can offer you some relief from TDS, provided you meet certain eligibility criteria for it. This means, submitting Form 15G and 15H can make sure that your income through interests or dividends is not taxed (provided it is under ₹2.5 lakh.)

- Where can I download forms 15G and 15H?

You can download Form 15G here, and Form 15H here.

- What is form 16?

According to the Income Tax Act of 1961, an employer is mandated to issue a Form 16 (typically with a quarterly breakdown) to any employee who draws an annual income of more than ₹2.5 lakhs. It is a record of the TDS being cut by your employer.

- More From The Personal Finance