An idea becomes a registered company,

with 2 employees: A UX researcher

(aka Satyajeet, the founder), and an app

developer (aka Saiprasad, the CTO).

An idea becomes a registered company,

with 2 employees: A UX researcher

(aka Satyajeet, the founder), and an app

developer (aka Saiprasad, the CTO).

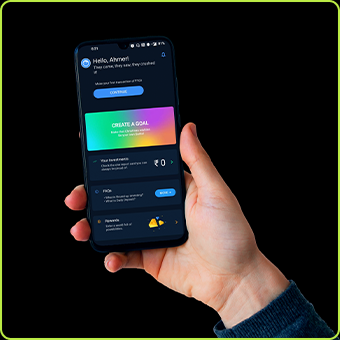

Beta version of the app rolls out for select

users. Feedback loops get kicked off.

Beta user base crosses 50K. Team moves from

house hopping, to an office of their own!

Pre-seed round of $1M from a troupe

of eminent VCs, entrepreneurs and

creators is raised.

User base crosses 1 Lakh!

Team of 5, grows to team of 15.

New faces, new ideas, same drive.

Deciml becomes the first Mutual Fund app

in the round-up investing space! First ever

large-scale marketing campaign goes live.

This new website page gets made. Team

reminisces about their journey so far, does a

fun photoshoot (scroll below!) before getting

back to making investing cooler for you.

A small thought becomes a registered company, with 2

employees:

A user research and product manager (aka Satyajeet, the founder), and an app

developer (aka Saiprasad, the CTO).

Beta version of the app rolls out for select users.

Feedback loops get kicked off.

Beta user base crosses 50K. Team moves from house

hopping, to an office of their

own!

Pre-seed round of $1M from a troupe of eminent VCs,

entrepreneurs and creators is raised.

User base crosses 1 Lakh!

Team of 5, grows to team of 15.

New faces, new ideas, same drive.

Deciml becomes the first Mutual Fund app in the

round-up

investing space! First ever large-scale

marketing campaign goes live.

This new website page gets made. Team reminisces about their

journey so far, does a fun

photoshoot (scroll below!) before

getting

back to making investing cooler for you.

Founder & CEO

Secret Shayar & Taboo Champion

CTO

Guitarist & Dad-Jokes-Master

CMO

Globe Trotter & Comebacks Connoisseur

Head Of Growth

Tennis Player & Cricket-Facts-Dealer

Customer Experience Manager

Supermodel & Conference Room Singer

Senior Software Engineer

Petrolhead & Paneer Aficionado

Content Marketing Manager

Gourmet Chef & Big Boss Buff

Senior Backend Engineer

Notion Expert & Dosa Enthusiast

Software Engineer

Gamer & Photoshoot Misser

Digital Marketing Manager

MMA Enthusiast & Desktop Over-Organizer

Content Head

Singer & Resident Clown

Customer Experience Manager

Aspiring CEO & Pantry Planner

Customer Experience Associate

Baker & Avocado Toast Authority

Write to us!

Write to us!

Content Head

Singer & Resident Clown