Wise Up

Asset Management Companies (AMCs): An Overview for Young Investors

Welcome to the world of investing… Where the information available is an ocean, and only a select few have the ship to survive these overwhelming waters.

So, to invest in mutual funds (or really even make heads or tails of it at all!), you need a ship. This metaphorical ship manifests in the real world as a company that will guide you through your investment journey.

What is the meaning of an asset management company?

An asset management company (AMC) is a firm that manages and invests money on behalf of its client, a.k.a. the investor – a.k.a. you! – across various financial securities. These could include mutual funds, stocks, bonds, real estate, and other financial assets like these. Asset management companies will create and manage your investment portfolios, exposing you to a range of mutual funds and other investment instruments, to meet your individual financial goals.

What does an asset management company do?

When you approach an asset management company, you will be assigned a fund manager who will be in charge of your financial portfolio. Become best friends with this person! And pay close attention to the advice you receive from them.

The most important job of the fund manager is to understand what you are looking for from your investments and use this knowledge to make an informed decision about what assets need to be allocated to you. For instance, if you are looking for diversity then your capital allocation is going toward balanced funds, which invest in a mix of fixed-income securities and stocks.

It becomes the responsibility of your fund manager to perform the 3 key functions of the asset management company to help you build a robust portfolio. We’ve made it an acronym – ICE – for you to easily remember these functions –

- Investigation – We’ve already touched upon the primary research that an asset management company needs to carry out – which is finding out about your financial goals, risk capacities, and investment horizons. But secondary research is equally important when it comes to asset management. It is the job of the AMC to research and analyze the past, present, and projected performances of various asset classes. A thorough study of the market as well as the economic factors that influence the market is required to help you make big gains from your investments. The investigation function of an asset management company results in you being presented with vetted, viable, and lucrative investment options.

- Construction – All the top asset management companies in India will have a dedicated team of researchers and analysts to help the fund managers achieve point #1 ☝🏼 in this process! When they have reported their findings to the fund manager, then the fund manager will align with you and decide which securities to buy and sell. Gradually, your investment portfolio will start bulking up! This is a tricky function for an asset management company to consistently perform because it depends largely on the caliber and expertise of your fund manager. So, be wise when you decide who’s going to be steering this ship for you! The construction function of an asset management company is what will help you – slowly, but surely – build the financial portfolio of your dreams!

- Evaluation – Turns out performance reviews aren’t just employee evaluations. Your investments need performance reviews too! Asset management companies are mandated to provide you with each and every piece of information that is pertinent to your investments. This includes updates on transactions, NAVs, and even relevant market news. Additionally, any reputed asset management company will routinely send you information on new investment opportunities that you could capitalize on. Based on the learnings from such information, your fund manager can also make alterations to your portfolio and reallocate your funds, as needed (read: go back to step 1, tweak, and repeat!). The evaluation function of an asset management company will allow you to routinely change your investment strategy, and leverage any opportunity to diversify in a timely manner.

Asset management companies have an important role to play, and ICE helps them help you stay on top of your financial game!

Checklist for Young Investors

Disclaimer – Selecting an asset management company requires thorough and extensive research.

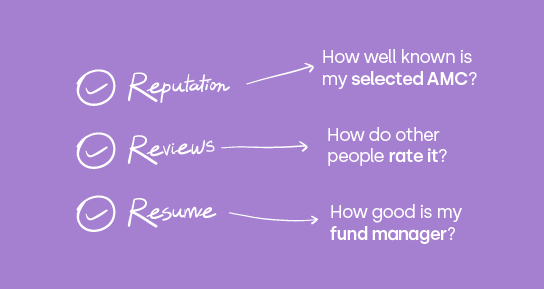

But, we thought we’d share a quick checklist of things to look for in an asset management company to help you get started.

- Reputation – A reputed asset management company is an absolute must. It speaks to the accountability and goodwill of the company, which are both important elements when it comes to your financial security.

- Reviews – You have to seek out reviews and feedback from other customers of any asset management company. Look into what your fellow investors are saying, folks – it always helps to know how a company treats its customers.

- Résumés – An asset management company’s performance on one side, and your fund manager’s level of expertise on another! Look into how your asset managers have performed with other customers, and across assets.

Believe us when we say that unless you’ve checked off these 3 things in your background check on an asset management company and a fund manager – you’re still looking for the right fit!

We’ll leave you with a list of some of the top asset management companies in India today –

- SBI Mutual Fund

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- Kotak Mahindra Mutual Fund

- Nippon India Mutual Fund

Well, there you have the list – time to start researching the AMC that is right for you!

FAQs

- What is an asset management company (AMC)?

An asset management company (AMC) is a firm that manages and invests money on behalf of its client (investors) across various financial securities including funds, stocks, bonds, etc.

- What are the biggest asset management companies in India?

SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential Mutual Fund, Kotak Mahindra Mutual Fund, and Nippon India Mutual Fund are some of the biggest asset management companies in India today.

- What to look for when vetting an asset management company?

Three things you should vet about an AMC include its reputation, its customer reviews, and the credibility of your fund manager.

- What are the functions of an asset management company?

Asset management companies have various functions including research and analysis of financial assets, trading in securities on your behalf, and reviewing your financial portfolio.