Wise Up

Financial Wellness: Everything You Should Know And Do

“I’d love to… but I just can’t afford it right now.”

From our perspective, Financial Wellness means eliminating this sentence from your vocabulary completely. A more technical understanding of Financial Wellness, however, is this – The ability to take control of your money to sustain you now and into the future. This means regular budgeting, planning to leave behind any debt, building robust savings, and investing to make your money work for you.

Financial Wellness is something that is extremely important today – it can be the driving factor not only for financial stability but also your peace of mind. So, let’s start with the question you’re probably asking yourselves right now – Um… But Why is Financial Wellness important? Is it really so important that we need to read a whole blog about it? (Spoiler Alert – It is!)

Having a financial plan in place might seem like something that can be kept on the back burner because you’re young and carefree. But believe us when we say, the need for a solid monetary plan creeps up on you and becomes a source of immense stress. And stress is a major buzzkill! Giving priority to your financial portfolio can alleviate some of the stress that comes when finances become a burden rather than an opportunity.

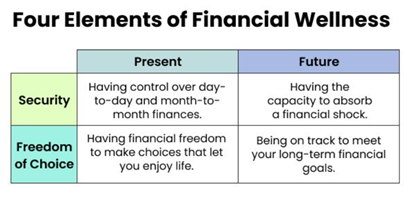

Source: U.S. Consumer Financial Protection Bureau

This depiction of Financial Wellness by the US Consumer Financial Protection Bureau perfectly encapsulates what Financial Wellness means. It means having the security to control your present and future, and having the freedom of choice to make whatever financial decisions are necessary in your present and your future. Financial Wellness ultimately offers you autonomy in your life and makes it so money is never the reason you are not reaching out to achieve your goals.

Now, it’s all good and well to know why we need it, but we like to equip our readers with more actionable tips. So, here are some ways in which you can kickstart your Financial Wellness journey –

1. Plan – Know what’s coming in and what’s going out, and create a monthly budget for yourself. This includes tracking your expenses on a daily basis and making sure your budget accounts for a savings fund, as well as an investment fund. No, those two are absolutely not the same thing!

Aim – To get acquainted with Excel and make yourself a spreadsheet, OR download a budgeting app that can help you get started.

2. Save – This brings us to the savings bit. Saving money is prudent and necessary. It gives you the chance to create a security blanket for yourself and your family. Having a healthy savings nest can remove a lot of pressure from making tough life decisions because you at least know you are financially secure.

Aim – To create enough savings that can keep you afloat for at least a year (to begin with!) if you were to have no income at all for that year.

3. Invest – The second important part of your budget is the investment bit. This one can be intimidating, but some might argue that it is ultimately the biggest driver for Financial Wellness. Investing allows you to make your idle money grow. Explore the option available to you for investing, and take the plunge sooner rather than later.

Aim – To start micro-investing with apps like Deciml (of course, at least 1 plug-in was coming) which enable you to start investing with small amounts so you can start early and earn more.

4. Manage – You need to manage debt. Whatever form it may be in – you need to have a plan and corresponding funds to make you debt-free. This is paramount for Financial Wellness. You cannot experience true financial freedom unless you are free from any outstanding ongoing expenses toward loans and credits.

Aim – To identify your source of debt and create a timeline within which you aim to eliminate said debt from your life.

5. Insure – Insurance is important. In fact, it is good sense to regularly pay a premium and have yourself and your family financially protected in case of any financial or personal emergencies. This one is essential for the ‘peace-of-mind’ aspect of Financial Wellbeing.

Aim – To determine what kind of medical and life insurance policies are out there and create room in your monthly or yearly budgets to make payments towards those insurance policies.

There are concrete steps you can take to attain financial nirvana – and the important thing to remember is that you can take concrete steps towards attaining Financial Wellness. There’s no better time to start this journey than NOW.

- More From The Uncategorized