Wise Up

What Is An NFO And How To Analyze NFO Schemes?

We talk a lot about diversification.

So, it’s only fair that every now and then we share some diverse investment options with you as well!

Today, we’ll talk about one such option – NFOs.

What is NFO?

The full form of NFO is a New Fund Offer and is the first-time subscription offering of a mutual fund scheme to the public. NFOs are typically launched when a mutual fund company introduces a new fund in the market.

Key Features of NFOs

You might need some help identifying NFO mutual funds. So, here are the distinct features of NFOs that you need to keep in mind –

- Fresh Start – As the name suggests, an NFO represents a fresh start for the fund. This means that it presents an opportunity for investors like you to become part of a scheme right from the beginning. Points 2 and 3 are also important contributing factors for you to be able to leverage this fresh start!

- Fixed Initial Price – During the NFO period, the fund’s units are typically available at a fixed price, usually ₹10 per unit. This initial offer price is known as the Net Asset Value (NAV) and does not change throughout the NFO period.

- Limited Time Offer – NFOs have a limited subscription period, called the NFO period, which is usually 15 days. Investors can invest in the NFO only during this window. So if you want to invest in NFOs, you have to do your research ahead of time and be ready to jump at the chance to invest when the window opens.

- No Market Volatility – Since NFOs are not listed on the stock exchange initially, they are not subject to market price fluctuations during the NFO period. You are investing the fixed price, during the fixed time, as promised.

Now you know the key features that define NFO mutual funds. But, simply knowing these features is not enough – is it?

Analyzing NFO Schemes

It is important to understand how to analyze NFO schemes before investing. Here are some key factors to consider –

- Objective – The first step is to understand the NFO’s objective. You need to know the answers to some important questions – “Is it an equity fund, debt fund, or hybrid fund?” “Does it align with my investment goals and risk tolerance?” You cannot know these answers unless you know what your fund’s objective is – whether it is growth, stability, income generation, or something else entirely.

- Reputation – You have to dig deep when researching the NFO company. Find out about their customer experience, their employee experience, their innovative strategies, and their management team. Factors that influence a fund house’s reputation have a direct impact on its market value and by extension, on your investment!

- Strategy – Study the investment strategy the fund will employ. For example, in an equity fund, will your money be invested in large-cap, mid-cap, or small-cap stocks? In a debt fund, what is the credit quality of the bonds that your money will be invested in? The answers to these questions can highlight the risk exposure, investment horizon, and goal of the NFO.

- History – There is obviously no history or track record for NFOs – since they’re brand-new funds! But, you can check the history of the fund house itself! You can also check the performance of individual fund managers, to make sure that your money is going into the best hands.

- Expense – Check the expense ratio, which represents the annual cost of managing the fund. Naturally, lower expense ratios can have a positive impact on your returns over time. It also helps to understand whether or not an exit load is applicable to the fund, which is the fee you pay if you redeem your investment before a certain period or if there’s a lock-in period in place.

- Requirement – If you are a young investor who is already ready to invest in an NFO, the question that is most likely to be swirling around in your mind right now is – “How little can I invest?” (We totally get that! 🤣) Well, depending on the fund house, the minimum requirement for NFOs can vary from ₹500 to ₹5,000.

- Risk – 😀 ”Please read the offer document carefully before investing!”

- Implications – Some NFOs might have tax implications. This means checking up on whether your NFO offers tax-saving benefits, or whether there are taxes levied on your withdrawals and maturities.

You have to take stock of all these elements before you invest in any NFO. But, don’t be turned away by these, there are a number of advantages that make the effort worthwhile.

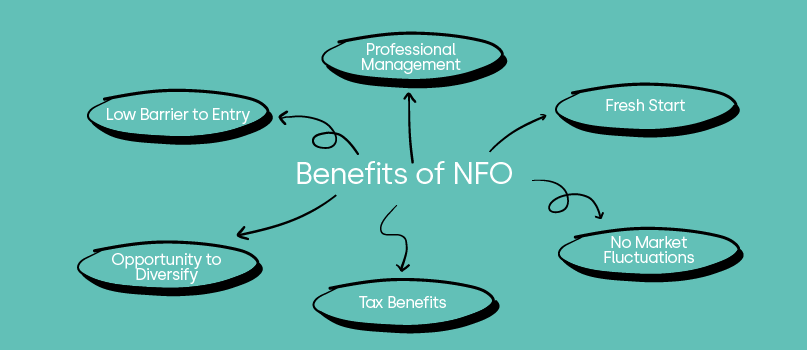

Benefits of Investing in NFOs

Leveraging the benefits of NFOs can be crucial to your overarching investment strategy. You can leverage all the features of investing in mutual funds, while also ensuring that your purchase price is fixed, and unaffected by market changes. It is a great option to explore in case you want to diversify your portfolio.

FAQs

- What is NFO in mutual funds?

The full form of NFO is a New Fund Offer and is the first-time subscription offering of a mutual fund scheme to the public. NFOs are typically launched when a mutual fund company introduces a new fund in the market.

- What are the key features of NFOs?

NFOs are only available at the fixed NAV of ₹10 per unit, for a 15-day period. They allow you to get in on the ground level since it is a fresh fund, and your purchasing power is not affected by market conditions due to the fixed price of the NFO.

- What are the best upcoming NFOs?

Some NFOs that are open for investments till November 2023 include – 8th November 2023 – Kotak Consumption Fund – Regular (G), and 10th November 2023 – Aditya Birla SL Transportation and Logistics Fund-Reg (G).

- How can I analyze an NFO scheme before investing?

There are various factors you need to consider before investing in an NFO scheme. These include – the fund’s objective, reputation, strategy, expense, barriers to entry, risk, and tax implications. You can also look into the past performance of the fund house or fund manager.

- More From The Investment