Wise Up

Saving vs. Investing - A Look At Why We Need Both!

Federer vs. Nadal.

Ronaldo vs. Messi.

Tendulkar vs. McGrath.

Each of these duos is an exemplary pair of athletes, and each personality is a legend in his own right!

This is illustrative of how one should perceive saving vs. investing. The match between these two is one for the books and saving and investing are both superstars in their own unique way! 🙂

Saving and investing are both instruments of financial management that can help individuals create financial security and stability for themselves. In the fundamental sense, saving refers to setting money aside from your income to use in the future, while investing refers to purchasing assets that can earn returns.

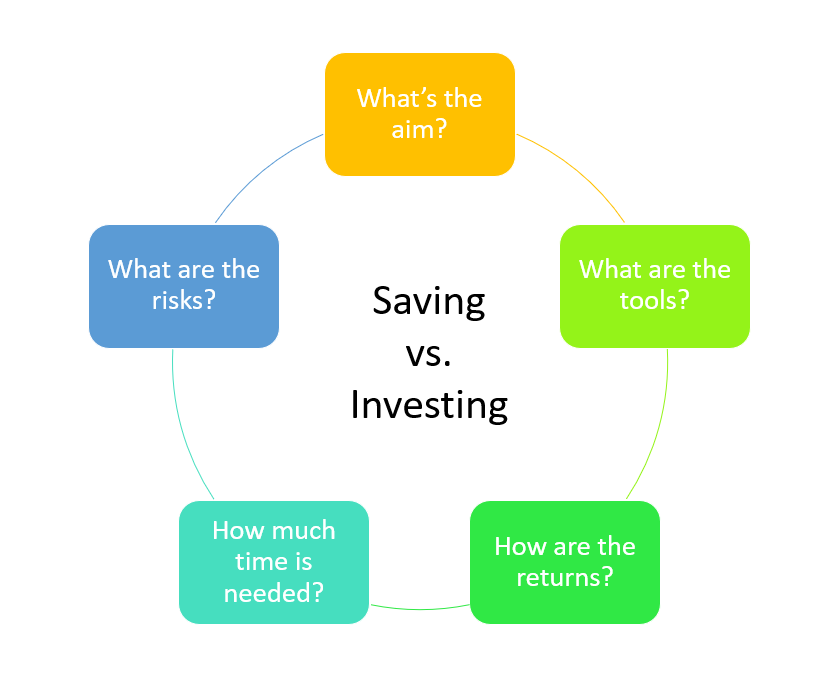

Today we wanted to delve into some of the key parameters (which are important in personal finance management!) that make saving and investing different from each other –

#1 – Goal – What’s the aim?

Saving – The goal of saving is primarily to meet short-term goals or create a nest egg for unforeseeable emergencies.

Most people save money with the goal of creating capital and that’s it! You can think of it as knitting a security blanket for yourself but putting aside a little bit of money every time your salary gets credited to your account.

Investing – The goal of investing is to save and get returns on the capital that is being saved (and eventually invested). So, you are essentially buying assets through accumulated savings that will grow over time, earning you returns.

This means that the key goal of investing is growing your wealth – for the bigger goals and to support important life milestones.

PS – One important goal of saving could also be investing!

#2 – Scope – What are the tools?

Saving – If you have a bank account that does not hit the ₹0 mark after all your monthly expenses – you are already saving money. A savings account is the easiest way to save money.

Other tools for saving money include using Fixed Deposits (FDs) or Recurring Deposits (RDs). These options are better than simply letting your savings sit in your bank account, as they provide slightly better interest rates.

Investing – There are so many investment options available out there today that can be valuable instruments for growing your wealth.

Right from mutual funds and stocks to real estate and gold – there is a whole assortment of investment options out there for you to choose from. What you pick to invest in should align with your personal and financial goals.

Today, young investors even have investment options that require minimal capital, like Deciml, for instance, which allows young investors to start their investment journey with as little as ₹1!

PS – Micro-investing is a great way to save and invest money all at once!

#3 – Risk – What are the risks?

Saving – Simply accumulating your savings in your bank account is the closest you can come to a risk-free option! If you get into options like FDs and RDs, then your savings are considered to be low-risk (not no risk!). With these two scenarios, it is safe to say that saving money is relatively free of risk.

Investing – Investing can range from low-risk to high-risk investments. For instance, mutual funds are low to medium-risk options, whereas investing in stocks can be riskier.

Investing means you are moving your capital from your bank account and putting it in to purchase an asset that earns interest over time. But, investing is influenced by a number of factors – right from market fluctuations, to government regulations, and economic developments. You can mitigate some of your investment risks by leveraging rupee cost averaging for your SIPs. Remember that no-risk investing is not a thing!

PS – In spite of the risk factor, investing is an invaluable tool for financial growth and wealth creation.

#4 – Returns – What are the returns?

Saving – In India savings accounts offer an interest between 2.5% to 7%, contingent on the amount of savings in the bank account. For RDs, this range can be from 2.5% to 8.5%, and for FDs, it can be from 2.5% to 6.5%.

Bear in mind that these ranges are a general representation of savings interest rates in India, and can still vary outside these limits! Young professionals who are just starting out need to also keep in mind that they are likely to be at the lower end of the savings account interest rate to start with – which is why they need to also invest to grow their wealth.

Investing – Investing can garner a whole range of returns for the investor. Right from 2% all the way to 20% depending on the capital invested, fees and exit loads, and most importantly the tenure of the investment.

If you are investing in mutual funds through SIPs, or even if you are micro investing through an app like Deciml – remember, that the longer you stay invested the larger your returns will be.

PS – Saving and investing require discipline! Make sure you take care of saving and investing your money before you think about spending it!

#5 – Time – How much time is needed?

Saving – No time limits here. Saving money is a continuous process. Month after month, you have to make dedicated efforts toward saving money.

Whether you are saving it in your account, or through low-risk saving options like FDs and RDs, you have to save regularly to let your nest egg prosper. Your savings are highly liquid – meaning they are available as cash easily.

Investing – Investing money means some time will have to pass before you can liquidate your investment with a profit. Most investment options come with a lock-in period, and you will only be able to liquidate your investments at the end of this period.

This is an important difference between saving and investing – the ability to access quick cash! The two key principles of investing include compounding and rupee cost averaging – and the potential of both is truly unlocked when you stay invested for longer periods of time!

PS – Saving and investing money requires patience and regularity in order to see truly good results.

In addition to these key parameters, here are some more important distinctions between saving and investing –

- Saving and investing are both good options to accumulate wealth, but only the latter provides protection against inflation.

- Building a savings fund is relatively simple – all you need is an income! But investing requires meticulous planning and research.

- Other than a PPF (which can technically be a form of investing!), saving money alone does not have a lot of tax-saving potential. But investments like ELSS (Equity Linked Saving Scheme) mutual funds can help reduce your taxable income.

- You save money primarily through a banking institution, but investments can be done through a number of mediators, brokers, aggregators, and mobile apps!

It is important to always remember that saving vs. investing is first and foremost a “saving and investing” situation and less of a “saving instead of investing” situation. Both these tools of financial growth go hand-in-hand and both have their merits for your financial future (both, short-term and long-term).

The key takeaway here, we hope, is that the difference between saving and investing should serve as a reminder of why you need to be doing both, and not either one!

FAQs

- What are saving and investing?

Simply put, saving means you are taking a part of your income and setting it aside to accumulate a nest egg. Investing means you are using a part of your income to purchase assets that will earn you interest and returns over time.

- Why do I need to save money?

Saving has two primary purposes – creating a bank of money to help you in case of unforeseen circumstances or emergencies, and fulfilling certain short-term goals.

- What are the ways in which I can save money?

The most common form of saving money includes creating a savings account in a bank. People can also save money by putting it into Fixed or Recurring Deposits. Buying gold can also be considered a form of saving.

- What are some investment options in India?

You can invest in liquid, debt, and equity mutual funds, the stock market, Public Provident Fund (PPF), Exchange Traded Funds (ETFs), insurance, gold, and real estate – the options are abundant.

- Is it better to save or invest?

Both, saving and investing are important tools for financial growth and wealth creation. One is not better than the other, because ultimately both are extremely important for any individual’s financial security.

- More From The Investment